Algorithms and the Asset Class: How AI Is Reshaping Commercial Real Estate

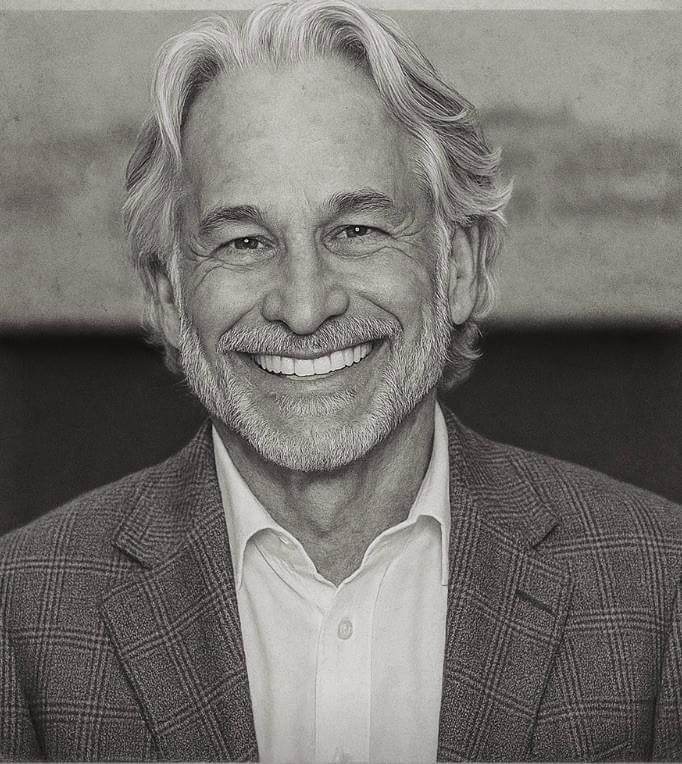

- Lewis Feldman

- Nov 1, 2025

- 3 min read

Michael Milken once told a class at Wharton that prosperity is nothing more—and nothing less—than the application of technology to people, things, and ideas. At the time, the remark felt like aclever inversion of classical economics. Today, it reads like prophecy. The fusion of artificialintelligence with human capital, intellectual capital, and real assets is no longer theoretical; it hasentered the formative phase of a transformation that will reach deeply into commercial real estate.

The numbers alone tell a compelling story. The global market for AI in real estate is projected togrow from roughly $222.65 billion in 2024 to over $300 billion in 2025, with annual growth above35%, and forecasts stretching toward nearly $1 trillion within a decade. Adoption mirrors thissurge. More than 70% of real estate professionals now rely on at least one AI-driven tool in theirworkflow, and consumer reliance is not far behind: a recent Realtor.com survey shows 82% ofAmericans consult AI for housing market intelligence. Combined with estimates that more than athird of CRE-related tasks could ultimately be automated, AI is shifting from a novelty to anecessity.

For an industry that moves trillions of dollars and shapes the very environments in which peoplelive and work, this shift is profound. Property acquisition—once the domain of spreadsheets,phone calls, and instinct—is increasingly mediated by machine-learning tools capable of scanningthousands of data points and identifying not just comparable sales but hidden trends in climate risk,zoning, infrastructure, and tenant mix. Transactions that once took weeks of due diligence can nowbegin with predictive valuations delivered in minutes.

Lease management is undergoing a similar quiet revolution. AI models abstract terms, enforcetriggers, and predict renewal probabilities. The knock-on effects are significant: loweradministrative overhead, improved compliance, and fewer costly mistakes in multi-propertyportfolios. In building operations, AI systems link to sensors and IoT devices to anticipateequipment failure, optimise HVAC loads, and adapt energy consumption to occupancy in realtime. What was once a fixed cost becomes a variable one—responsive not to an engineer’s gut but to data.

This technological evolution extends beyond the operations room to the tenant experience itself. Ina sector where occupancy and retention define asset value, AI-driven service is emerging as adifferentiator. Virtual concierges handle maintenance requests, parking allocations, and securitypermissions. Chatbots respond to queries before tenants pick up the phone. For institutionallandlords, the promise is clear: lower friction, higher retention, and more precise insights intotenant sentiment.

Perhaps the most consequential frontier lies in investment and planning. AI can digest marketbehaviour—interest rates, construction costs, political signals, and demographic shifts—andmodel them against geographies and sectors. For lenders and investors, this offers a form of early-warning radar. For urban planners and policymakers, it introduces the possibility of simulating thesocial and economic effects of development before a shovel hits the ground. Affordable housing,homelessness, and climate resilience—issues once relegated to academic debate—may soonbecome variables in standard planning models.

None of this is without risk. AI systems learn from historical data, and real estate history includesdiscrimination, redlining, and exclusion. Without vigilance, those patterns can be replicated, notremedied. Privacy—particularly in residential settings—poses another concern, as doesexplainability in underwriting and appraisal. And there is the broader governance challenge:ensuring that the models guiding multi-billion-dollar decisions are accountable, transparent, andbias-checked.

Still, the direction of travel seems clear. If the first digital wave in real estate brought listings onlineand centralized data, the second wave—powered by AI—will alter the way capital is allocated,how assets are managed, and how cities grow. The winners will not be those who simply adopt newtools but those who integrate them thoughtfully, combining machine capability with humanjudgment, and innovation with ethics.

Milken’s notion—that prosperity arises from technology applied to real problems—captures themoment. Commercial real estate is beginning to align capital, talent, and algorithms in ways thatmay reshape everything from office leasing to urban policy. What appears incremental today may,in hindsight, prove foundational.For insights into real estate and tech application, please contact us.

Comments